Accounting Records are very useful for your company’s success!

Accounting is a necessary duty all businesses must provide for, one way or another. Whether you do your own books in-house or outsource these duties, reading the information provide by the bookkeeping records will help you in your role as a manager.

Here are four ways to use the information collected through your bookkeeping processes. Your company cannot survive without making a profit. You must provide for yourself through the operations of your business as well as your employees.

Breaking-even is not enough! To survive means that your company earns a profit.

How do you know if your efforts at this are paying off? Through the reports that are generated by bookkeeping – the recording of your company’s financial transactions – to paint a picture of profit or loss.

4 management tools for you to use for continued success…

- Know your Expenses — Tracking what it cost you to be in business is critical. Setting up a record-keeping system to manage your operating expenses will provide you with important information. Not knowing what you are spending can quickly get you into trouble.

- Tracking Sales — Let’s face it, you love what you do but can’t do it for free. This area of accounting record keeping is the life blood of your company. It is also one place to start to track your profitability. Your sales minus your job costs are imperative for your success.

- Managing & Administering Payroll — Your employees are the backbone of your operations. Keeping them employed is a responsibility that must be managed for two reasons. First, your employees need to earn an income. Second, there are multiple government agencies that require their share. Tracking the payroll obligations is important to keep current.

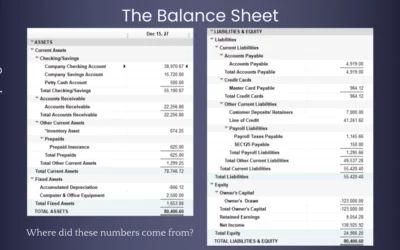

- Your Company Financial Reports — The Balance Sheet provides a snapshot of what your company owns, what your company owes, and what equity is owned and by whom. The Income Statement provides your Gross Profit and bottom-line Net Income. You track sales minus any costs of sales. Then you track your expenses to obtain your company’s net income. Finally, your company’s Cash Flow Statement provides an accurate picture of the cash in your company. Cash and income are different! The three accounting reports are your financial reporting lifeline.

Balance Sheet Snapshot

Knowing how to use these accounting recordings are powerful tools for you as the manager. It makes sense to know where your operating costs are going. Your Balance Sheet Liability Accounts give you a high-level view of the payments going out. You should be reviewing this report every month.

Profit and Loss – Hopefully Not

The revenue section of the Income Statement shows the overview of all sales. You can set up job costing to track Costs of Goods Sold – in a service business it is the labor, payroll taxes, and employee benefits applied to revenue. You will then learn if your jobs are profitable.

You can dig even deeper into your company’s profitability through the accounting reports. Are there areas for improved operation procedures? Looking through the financial statements will give you an edge as a manager.

Constant improvements will keep your competitive edge sharp. Knowing what to improve comes from learning all you can about your company’s profitability.

You do this through being able to read and use the information contained in the financial statements. Learn to use these powerful management tools as soon as possible.

We would love to hear from you about your biggest accounting challenges facing your company. Use the form on the link or leave a comment below and let us know what the challenge is.

Here’s to your success as a small business owner and manager.

Here is another timely article to help manage your business — Typical Business Expenses

0 Comments