Reckoning your company bookkeeping and payroll pledge

Staying on top of small business accounting for your continued success!

Covering some general accounting topics to help you compete in today’s crowded market. Accounting is a very important part of administering your business for many reasons. Staying current with your financial record keeping – Bookkeeping – will help you maintain constant knowledge of how your efforts to provide a product or service are doing. Keeping your employees and the tax liability current and paid is of equal importance. We will help you navigate these intricacies, so you stay focused on other areas of your operations.

Small Business Accounting Articles

4 Essential Tips to get your Finances ORGANIZED Using QuickBooks

In the Hectic World of operating your small business ... some guidance for keeping the financial picture clear Using...

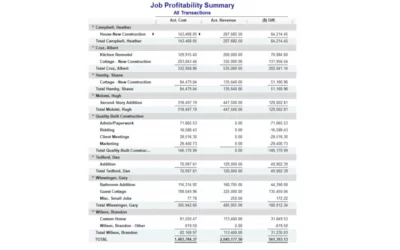

A Contractor’s Books Running Amok!

From Chaos to Smooth Sailing Building a house is fun right? Of course you have to perform a lot of work to get it...

Get Started with QuickBooks Online: Creating Your Company File Part-2

Gathering, Creating, Entering Data, the Chart of Accounts Gathering Required Information Before you can set up your...

Get Started with QuickBooks Online: Creating Your Company File Part-1

Introduction – Bookkeeping and the art of knowing! Running a successful small business If you have recently begun the...

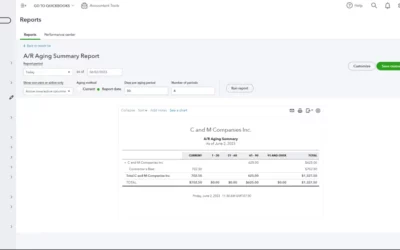

Bad Debt Accounting

If you extend time for your customers to make payments for services or products sold, you are a creditor. The 30-day-net month is a typical time allotment for your customer to submit payment. We track the amount owed in Accounts Receivable, or A/R, a Current Asset bookkeeping account.

Business Expenses – What are “Ordinary and Necessary” business expenses?

(The following article is presented for informational purposes only and does not constitute any recommendations for...

General Business Resources

SMART Goal Setting

SMART Goals – Specific, Measurable, Actionable, Relevant, & Time bound.

Small Business Survival Resources During the COVID-19 Pandemic

Resources for small business owners to utilize during the COVID-19 pandemic from government and private sources.

What is Currency Manipulation?

— How it Affects YouStocks, bonds, and commodities, including currency, are all traded through the global...

Business Plan How To

SBA's How To Write a Business Plan The Small Business Administration has put together and excellent interactive course...

Business Ownership Types

Nevada Small Business Development Center Forms of business ownershipNevada SBDC has provided this great resource about...

Reno Small Business Resources

Free Resources to help you succeed! There are many resources for the aspiring entrepreneur to utilize in the Biggest...

Our Editorial Department

We’re Still Hard at Work for You

Happy Thanksgiving 2022! Greetings esteemed client. I haven't posted a company update in a while and wanted to reach...

Making an Impact With Our Business Partners

Helping your company keep the office running like a well oiled machine!

Income Tax Disclosures

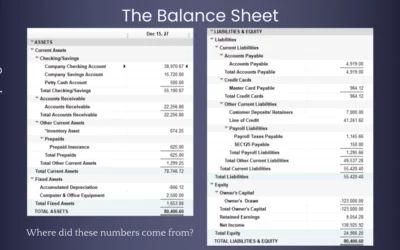

At C&M Bookkeeping, we work very hard for our clients providing weekly, monthly, quarterly and annual accounting support aimed at payroll, transactional, and record keeping organization for small businesses. This includes the necessary reports – the company’s Balance Sheet and Income Statement – used in income tax reporting preparations for the business portion of tax returns based on the information provided to us for accounting and record keeping purposes.

We post the transactions to the company accounting file that we are direct to record. We use these disclosed financial transactions to generate both of these reports. Company owners are responsible for accurately reporting all income and expenses used for the company tax preparation and accept all responsbilities for providing accurate and complete information for the reporting requirements.

We are not tax preparers and do not provide tax advice nor tax return preparation services. We suggest to our clients and prospective clients to always consult a professional tax advisor – such as a state registered Attorney or Certified Public Accountant or an Internal Revenue Service certified Enrolled Agent – for both your business and personal tax planning, compliances and tax return concerns.

General Information Disclaimer

The information contained on these pages and in our informational articles contained within our blog features are provided for general informational purposes only and do not constitute any business decisions nor recommendations. As there are financial and legal risks inherently involved in forming and running a business, we always recommend consulting with a qualified legal and tax professional when considering your business goals and risks acceptance.

Have Business Questions?

Have any questions about our service offerings and how we can help you succeed in business? Schedule a free 30 minute consultation by filling in our form below.