Bookkeeping for Small Businesses in Reno

We take the pain out of accounting!

You will have your company financial data organized and readily at hand!

When you hire us, the first thing we will do is learn your company. You will meet with us to go over background info. Then we will set up access to your financial data.

We will need bank statements, receipts, and invoices. If you do not have this set up yet, we will help you.

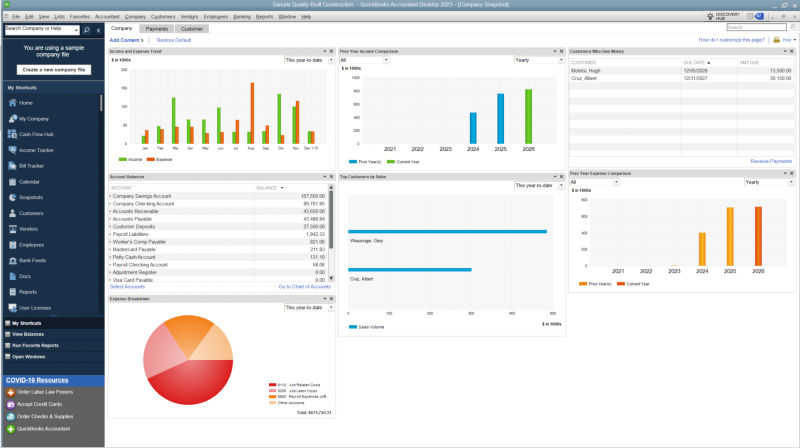

Then we will create what’s called The Company File in QuickBooks. This is where we will store all the different types of financial data.

All the company financial reports will be available after setup and data entry. We will help you every step of the way by being your accounting partner.

Bookkeeping is the art and science of keeping your company’s financial transactions balanced and organized. Having the books up to date is important.

You will know how well things are going. Without things like the Profit and Loss statement, you won’t know.

Then you will be ready for tax season. Your tax preparer will need the year-end financial statements.

Se Habla Español

Sirviendo a la comunidad Hispana de Reno desde 2011.

Llame a C&M hoy y mantenga su registros contables al dia.

Your company’s bookkeeping system is our number one priority. We will manage your bookkeeping tasks.

When you have a clear and complete picture of your company finances, you will be a better prepared manager.

Learn how we can help you manage these tasks so your focus can be on other operational responsibilities.

Get a Free half-hour small business consultation

We have affordable bookkeeping, payroll, and general office support services individually tailored to your specific company needs. We use QuickBooks Desktop Accountant and QuickBooks Online Accountant versions to carefully manage your company financial picture.

Call C & M Bookkeeping to schedule a free half-hour business consultation soon.

Se Habla Español

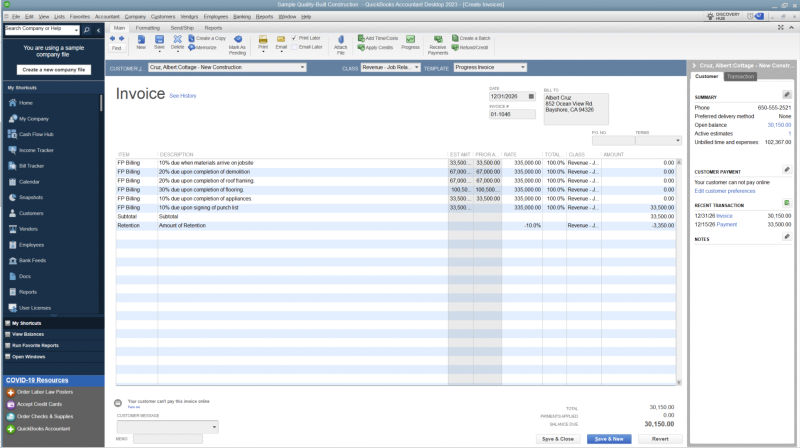

Image is a screenshot of an invoice from a sample construction company in QuickBooks Desktop version.

Common Accounting Terms

- Chart of Accounts

- Balance Sheet

- Income Statement

- Statement of Cash Flow

- Asset Accounts

- Property Plant & Equipment

- Liability Accounts

- Cost of Goods Sold

- Gross Profit

- Expense Accounts

- Net Profit

Journals & Ledgers

Here is a link to our blog page where we have posted concise articles about small business accounting topics. Please let us know if there are any areas of intertest that you would like to see covered in our next blog post.

Income Tax Disclosures

At C&M Bookkeeping, we work very hard for our clients providing weekly, monthly, quarterly and annual accounting support aimed at payroll, transactional, and record keeping organization for small businesses. This includes the necessary reports – the company’s Balance Sheet and Income Statement – used in income tax reporting preparations for the business portion of tax returns based on the information provided to us for accounting and record keeping purposes.

We post the transactions to the company accounting file that we are direct to record. We use these disclosed financial transactions to generate both of these reports. Company owners are responsible for accurately reporting all income and expenses used for the company tax preparation and accept all responsbilities for providing accurate and complete information for the reporting requirements.

We are not tax preparers and do not provide tax advice nor tax return preparation services. We suggest to our clients and prospective clients to always consult a professional tax advisor – such as a state registered Attorney or Certified Public Accountant or an Internal Revenue Service certified Enrolled Agent – for both your business and personal tax planning, compliances and tax return concerns.

General Information Disclaimer

The information contained on these pages and in our informational articles contained within our blog features are provided for general informational purposes only and do not constitute any business choices nor recommendations. As there are financial and legal risks inherently involved in forming and running a business, we always recommend that you consult with a qualified legal and tax professional when considering your business goals and risks acceptance.

Have Business Questions?

Have any questions about our service offerings and how we can help you succeed in business? Schedule a free 30 minute consultation by filling in our form below.