Gathering, Creating, Entering Data, the Chart of Accounts

Gathering Required Information

Before you can set up your company file in QuickBooks Online, it’s important to gather all the required information for your business. This will ensure a smooth and accurate setup process, setting the foundation for your small business success.

The information you will need to gather includes your company name, address, and contact information. This basic information is essential for accurately setting up your company file and ensuring that all your business details are reflected correctly in QuickBooks Online.

Additionally, you will need to gather information about your business type and industry. This information is important for categorizing your transactions and generating accurate financial reports in QuickBooks Online. Understanding your business type and industry will help customize the software to meet your specific needs and streamline your bookkeeping process.

It’s also crucial to gather your fiscal year and tax information. QuickBooks Online uses this information to generate accurate financial reports and assist with tax preparation. Ensuring that your fiscal year and tax information is correctly entered will save you time and headaches down the road when it comes to tax season.

Creating a New Company File

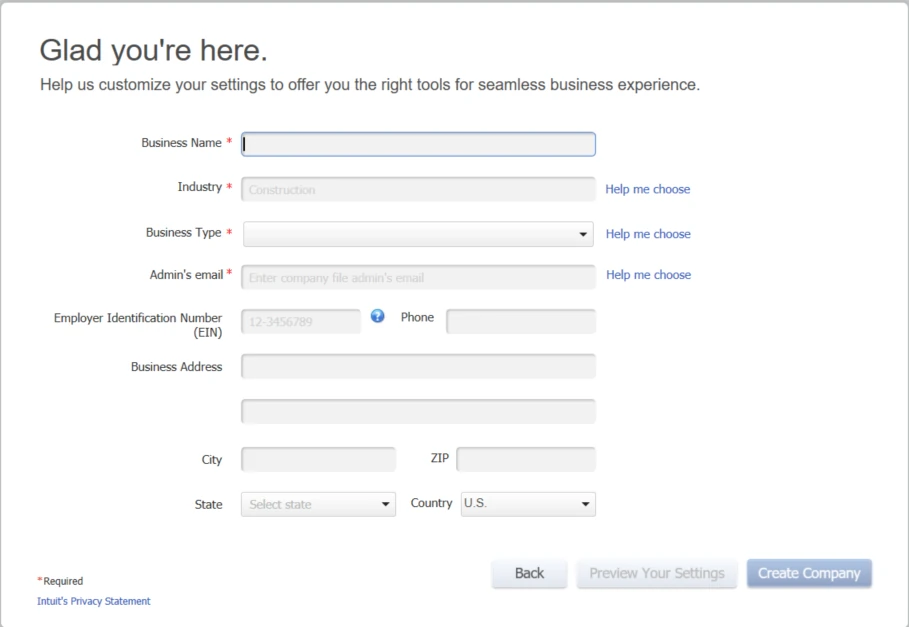

Creating a new company file in QuickBooks Online is an important step in setting up your small business for success. This process involves accurately entering your business information and customizing settings to meet your specific needs.

To create a new company file, start by logging into your QuickBooks Online account and selecting the option to create a new company. You will then be prompted to enter your business information, such as your company name, address, and contact details. It’s crucial to ensure that this information is entered correctly to avoid any future issues with your bookkeeping.

Next, you will need to select your business type and industry. This information helps QuickBooks Online categorize your transactions and generate accurate financial reports. Taking the time to choose the most appropriate options will ensure that you can effectively track your business’s performance and make informed financial decisions.

After entering your business information, you will have the option to customize your settings further. This includes selecting your fiscal year and tax information, as well as setting up your chart of accounts. Your chart of accounts is a crucial component of your company file, as it allows you to track your business transactions and generate accurate financial reports.

Once you have completed the setup process, take the time to review your company file and ensure that all the information is accurate. This includes verifying your business details, chart of accounts, and settings. Making any necessary adjustments at this stage will save you time and effort down the road.

Basic Company Questions

Entering Company Information

Entering your company information is a crucial step in setting up your company file in QuickBooks Online. This step ensures that all your business details are accurately reflected in the software and lays the foundation for accurate and efficient bookkeeping.

When entering your company information, start by inputting your company name, address, and contact details. Double-check that this information is entered correctly to avoid any future issues with your bookkeeping. Additionally, you may need to provide your tax ID or employer identification number (EIN) if applicable.

Next, you will have the option to select your business type and industry. This information helps categorize your transactions and generate accurate financial reports. Choose the most appropriate options that best describe your business to ensure accurate tracking and reporting.

During this process, you can also customize your settings further by selecting your fiscal year and tax information. QuickBooks Online uses this information to generate accurate financial reports and assist with tax preparation. Make sure to enter these details correctly to save time and headaches when it comes to tax season.

After entering your company information, take the time to review and verify all the details in your company file. This includes ensuring your business details, chart of accounts, and settings are accurate. Making any necessary adjustments at this stage will save you time and effort down the road.

Setting Up Chart of Accounts

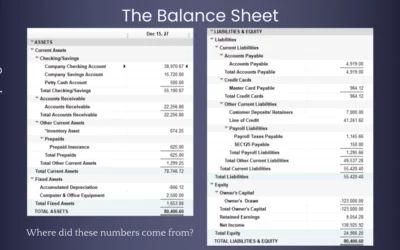

Setting up your chart of accounts is a crucial step in the setup process for QuickBooks Online. Your chart of accounts is a list of all the accounts that you will use to track your business transactions. This step is essential for accurate bookkeeping and financial reporting.

To set up your chart of accounts, start by understanding the different types of accounts you will need. Common account types include assets, liabilities, equity, income, and expenses. Depending on your business, you may need to customize your chart of accounts to include additional account types that are specific to your industry or operations.

Once you have identified the account types you need, you can begin creating individual accounts within each category. Each account should have a unique name and a corresponding account number. This will help you easily identify and organize your transactions within the chart of accounts.

It’s important to carefully consider the structure and organization of your chart of accounts. This will help you easily track and analyze your business’s financial performance. For example, you can create sub-accounts within each account type to further categorize your transactions.

Additionally, QuickBooks Online allows you to assign tax codes and other attributes to your accounts. This can help automate your tax reporting and streamline your financial processes.

Next Week…

Next week we will conclude this topic of setting up a new QuickBooks Online Company File. We want to help you make QuickBooks Online experience a productive one. So don’t hesitate to contact C & M Bookkeeping for help. Thanks and I will see you next week.

If you want to get some help getting going with your company accounting tasks, click here to send us a note and we will can meet to go over our services. We love helping our small business clients succeed!

0 Comments