Accounts Receivable Aging Report

How to deal with doubtful accounts

If you extend time for your customers to make payments for services or products sold, you are a creditor. The 30-day-net month is a typical time allotment for your customer to submit payment. We track the amount owed in Accounts Receivable, or A/R, a Current Asset bookkeeping account.

An accounting category called Doubtful Accounts is necessary if you provide credit to your customers. Accounts Receivable is used to track what is owed from your customers. When a customer doesn’t make their payment, it can hurt your business’s cash flow. Bad debts should be tracked for a few reasons.

The first reason is maybe obvious – so you can call your customer and remind them that they have missed making payment. Accounts Receivable that have aged more than 90-days become a big cash-flow issue for your company. You will want to stay ahead on collecting what is owed your business. This is the best reason for maintaining an Accounts Receivable Aging record.

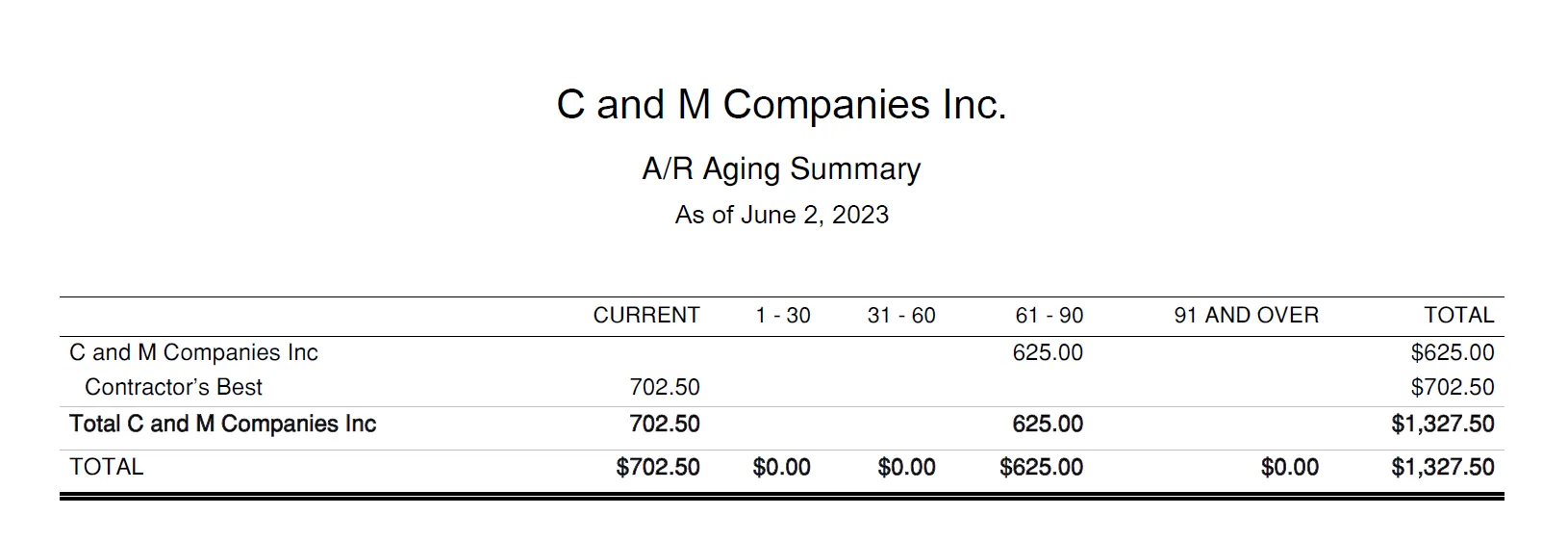

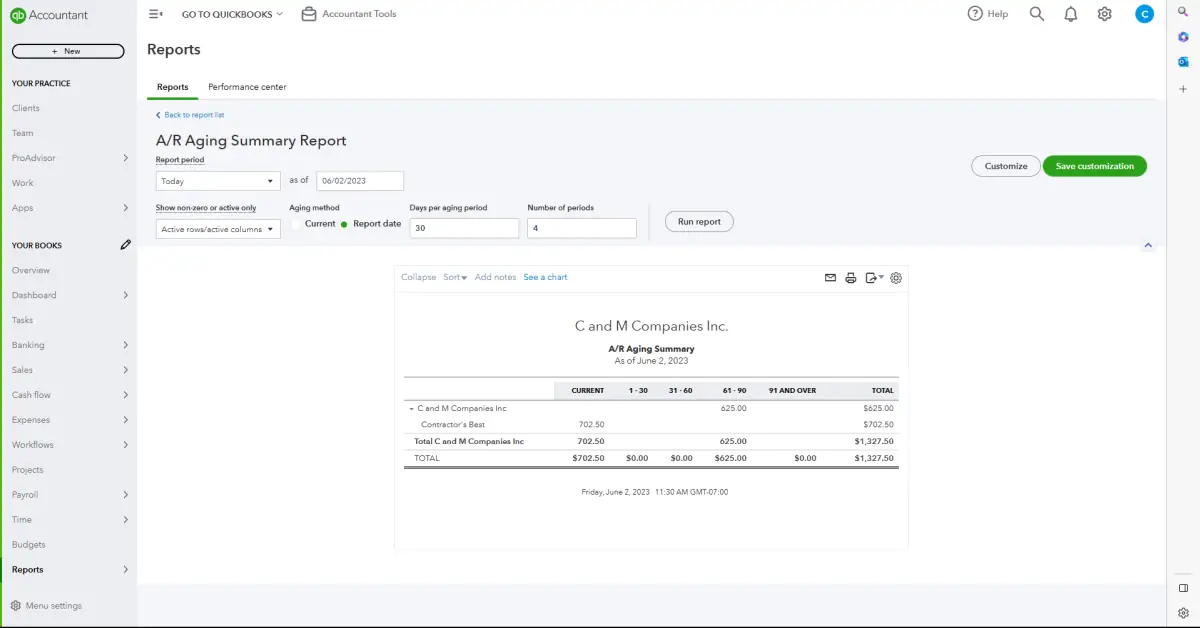

A QuickBooks Online A/R Aging Report Summary

Stay on top of Past-Due Collection

As you can see in the above example, the fictional company, Contractor’s Best has a balance of $625.00 that is between 61-90 past due. I would want to be calling this customer to see what is going on and encourage them to make a payment. This is the best reason for the small business owners to keep on top of the of the Accounts Receivable Aging Report. And to contact customers before it gets beyond 90 days past due.

What is Allowance for Doubtful Accounts?

The Contra Account Allowance for Dad Debt is based on a percentage of A/R and is influenced by your industry. This just means that you have a predetermined percentage allowance allocated on the balance sheet for bad debt.

It is commonly calculated from historical data. If you are just starting out in business, you can use the Direct Write Off method. After so many months have passed and you have exhausted all attempts at getting paid, you will write off the debt in your expense section and credit the A/R account the same amount.

Without getting too deeply involved in accounting methods here, lets review. The main point of this article is to encourage small business owners who extend credit to their customers to routinely review your A/R Aging Report and contact customers early to ask for payment.

Want insight on the set up process for QuickBooks Accounting Software? Read our article offering some tips and resources here.

If you would like to get help with setting up this functionality in your bookkeeping system, please give us a call to discuss your options. We remain committed to your success in business. Here are some timely business resources at your fingertips!

Why keep your bookkeeping up to date? Read this contractor’s story and stay ahead of the game!

0 Comments