(The following article is presented for informational purposes only and does not constitute any recommendations for your business. You should consult with competent legal and tax advisers to determine your best course of action for business and tax planning purposes.)

Your company Income Statement

The IRS allows businesses to deduct ordinary and necessary costs of doing business but what does this mean? In this article we will talk about deductible expenses. On your company’s Income Statement, most expenses are entered after the Gross Profit in the Income Section.

Income Section

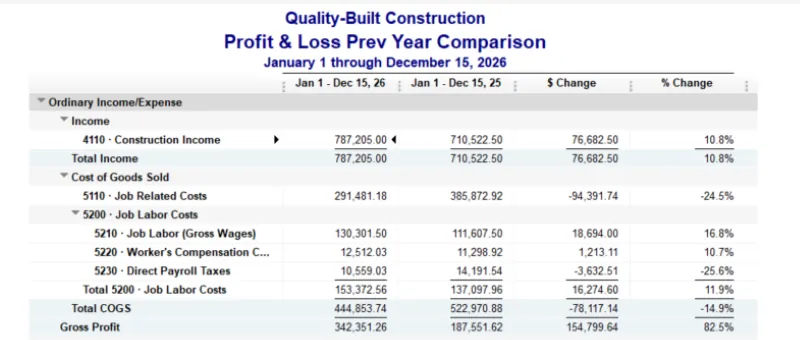

Sample Construction Company from QuickBooks Desktop

As you can see, the construction income and the cost directly related to this income are reported here – direct labor, insurance, subcontractors, materials, Etc. Costs of Goods Sold – COGS — are usually deducted from the revenue earned for the period, as shown above. In a service-based company, they are the Costs of Services, but for simplicity, everything is called COGS.

Notice the “Job Related Costs” above. These are any direct or indirect cost of, in this case, construction projects – job costs and job labor costs for the projects being reported for this period. If you are a service company and are not tracking job costs, these will then show up in the Expense section of your Income Statement.

The income section is very straight forward. It reports your sales revenues minus direct cost to produce these sales. Also in this example, we are using the Accrual Basis for reporting periods. This means that we report the income when it is earned, not necessarily when it is received from your client. Accounts Receivable will be a topic for another day.

As a note, you will have an Asset account called Accounts Receivable on your Balance Sheet to track this income. It will be transferred out of this account after you receive the payment from the customer. But the income is reported as if it were already received.

So, if you send out an invoice with Net 30 Days as the payment option, this income will be reported in the period that you create and send the invoice to your customer, not when you receive the payment.

Expenses

Let’s move on to the Expense section of the Income Statement.

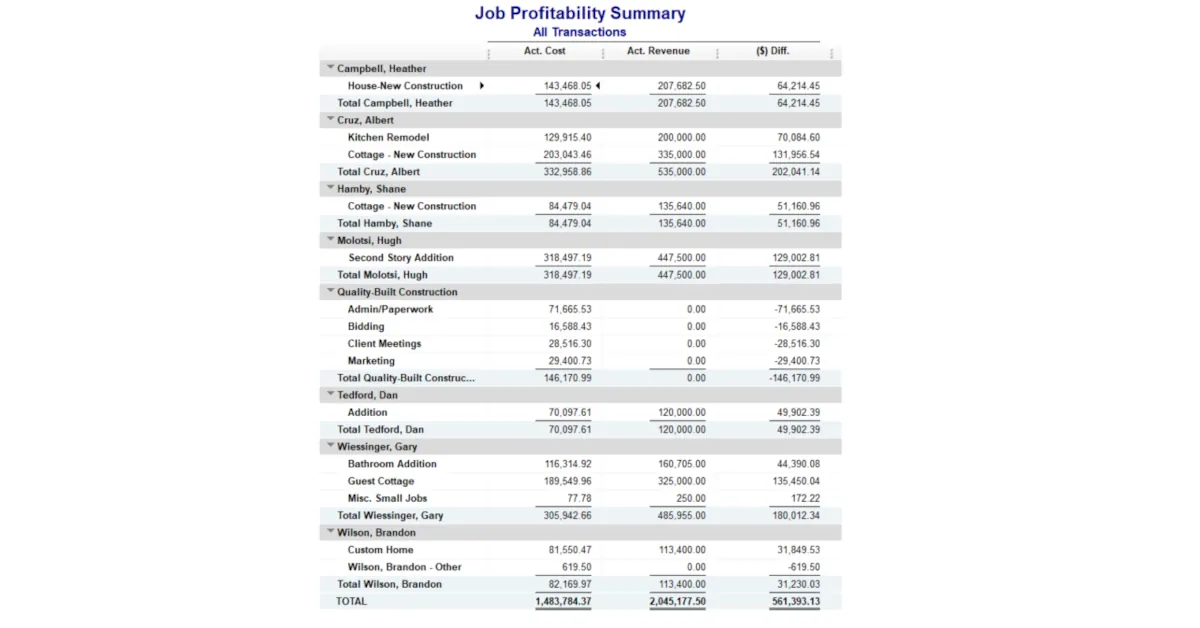

Sample Construction Company from QuickBooks Desktop

We just saw the income portion of the Income Statement. We saw that we can deduct the direct labor and indirect costs from this section to come up with our Gross Profit number. Expenses are sometimes called Selling, General, and Administrative expenses or SG&A. A great article on SG&A can be found over at Investopedia’s website.

Selling expenses include sales staff salaries, marketing expenses, advertising, and travel expenses for sales reasons.

General and Administration are also called Overhead expenses. Now we get into the Ordinary and Necessary expense that you track that show the costs of doing business. Do you pay rent for office space? Yes, then you would have deductible rent expense. Office and other support staff? Again, deductions for payroll expenses.

Generally, you can deduct these expenses from the company on your Income statement, but, as there are many rules, limits, and conditions involved in the U.S Income Tax code, always consult with your tax adviser first.

- Employees’ Pay – Consult your payroll or tax adviser

- Rent Expense – conditions apply!

- Some Interest Expense

- Some Insurance Expenses

- Vehicle Expenses

- Professional Services Expenses

This list does not cover all expenses and when you can deduct them as a business expense. I hope that it gives you an idea of what business expenses are and how we track them on your Income Statement.

I want to close by getting back to the IRS’s Ordinary and Necessary clause. Your method of reporting your income and expense during the normal operation of your business is important.

You will determine which method of accounting will benefit your business best when you meet with your tax adviser. Remember there are two methods: Cash basis and Accrual basis. Under the accrual method, you will need to make sure the business’s income and expenses meet certain requirements.

If you would like to talk more about your expense deductions, feel free to call us. Visit us at C & M Bookkeeping to learn more about what we offer to help small businesses keep their financial record complete and up to date.

0 Comments